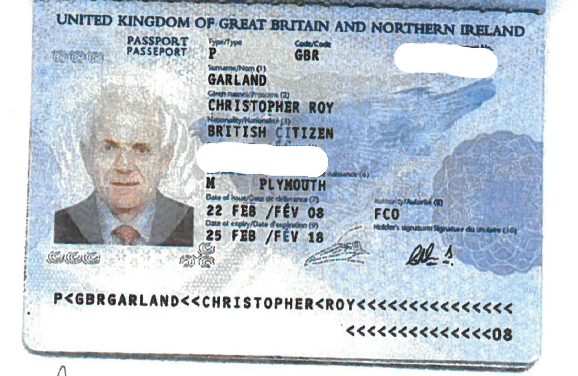

Garland's personal documents were handled by Mossack Fonseca officials in Seychelles

Botswana company in Panama Papers scandal

21 June 2018The deputy chairperson of a state-owned entity has been implicated in tax evasion and working to facilitate capital flight from Botswana.

Christopher Garland, Deputy board chairperson of Botswana Investment and Trade Centre, which is tasked with attracting foreign investment to the country; has been exposed as having ties to Mossack Fonseca, a law firm at the heart of tax dodging and capital flight from developing nations.

Hardly a year after the discredited Panamanian law firm was implicated in a global financial scandal, companies linked to Garland continued to utilize the firm’s services. This includes assisting businesses, individuals and wealthy families to open offshore accounts in jurisdictions classified as tax havens. Garland denies all allegations made against him. (See Garland’s response in full)

The law firm, which was at one point one of the biggest providers of offshore financial services, closed down in March blaming ‘the economic and reputational damage’ inflicted in 2016 after a cache of 11.5 million documents were leaked to German newspaper Suddeutsche Zeitung.

The Panama Papers, as the investigation is known, showed how the law firm helped its clients to launder money, dodge sanctions and evade tax.

BITC is a state-owned entity formed in 2012 following a merger between Botswana Export Development and Investment Authority and Botswana International Financial Services to promote Botswana as an investment destination of choice to foreign investors.

New data leaked to Suddeutsche Zeitung and International Consortium of Investigative Journalism and shared with INK Centre for Investigative Journalism, implicate Christopher Roy Garland, one of BITC’s long-serving board members, in a host of alleged misdemeanors.

These include:

- Using BITC to convince Mossack Fonseca not to cut ties with him (Garland) by leveraging Dölberg Wealth International Limited, and its subsidiary Tamayo Properties.

- Investing thousands of dollars in offshore companies with the assistance of Mossack Fonseca

- Assisting wealthy individuals, mainly from South Africa, to open and sustain offshore accounts using the services of MF

- Undermining the BITC’s efforts to attract foreign investors

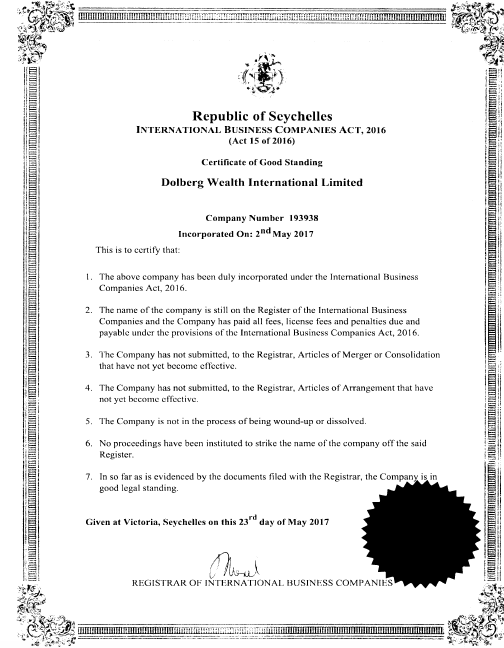

According to documents seen by INK Centre, immediately after the Panama Papers became public, Turnstone Corporate Limited, an Isle of Man and South African registered financial institution, changed its name to Dölberg Wealth International. Its Botswana subsidiary, Turnstone Corporate Botswana, later changed its name to Dölberg Fiduciary Botswana.

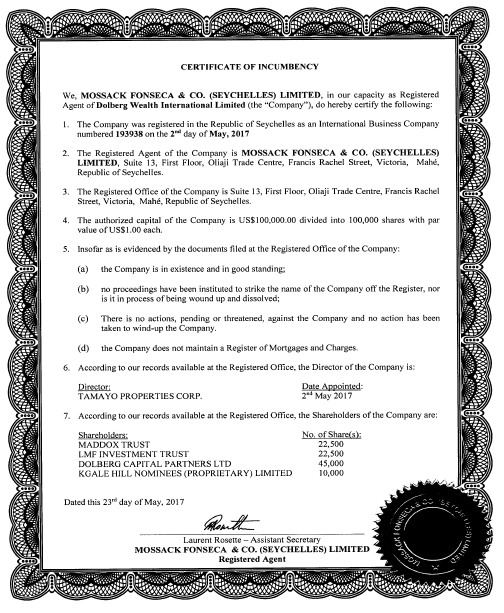

The company would later be incorporated on October 18, 2016, according to the leaked records. Garland, according to the files, is the director of both the Botswana and Isle of Man registered companies. The group, which was established in 1999, “offers fiduciary, corporate management and family advisory services to wealthy families, individuals and international clients across the globe.”

Garland’s Dolberg continued a ‘cozy relationship’ with Mossack Fonseca more than a year the company was exposed for aiding dictators, politicians and businessperson to hide their money and evade tax.

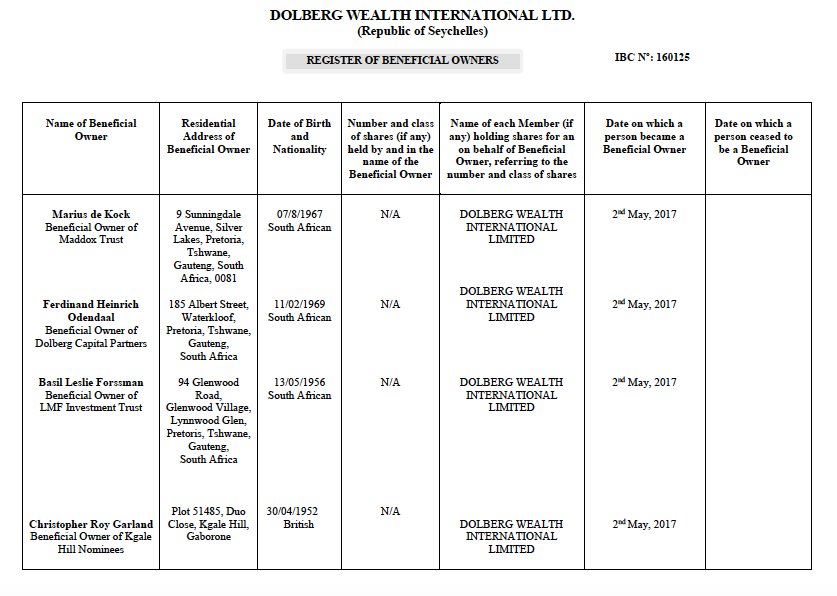

A document titled, “notice of becoming a beneficial owner’ dated May 31, 2017 shows that Garland became one of the beneficial owners of the main company on May 02, 2017. The documents signed by Garland reads, “I am the ultimate beneficial owner of 10 000 ordinary shares in the company having a par value of US$ 1.00 each, which shares are held and registered in the name of KGALE HIL NOMINEES (PTY) LTD who is the shareholder and holds the shares as nominee for and on my behalf.”

Garland a ‘Politically Exposed Person’ – Mossack Fonseca

This document, announcing Garland as a beneficial owner, did not sit well with Mossack Fonseca, who were worried that Garland was a ‘politically connected person due to positions he held in state-owned entities. The law firm immediately launched its investigations and concluded that Garland may be a ‘politically connected person’.

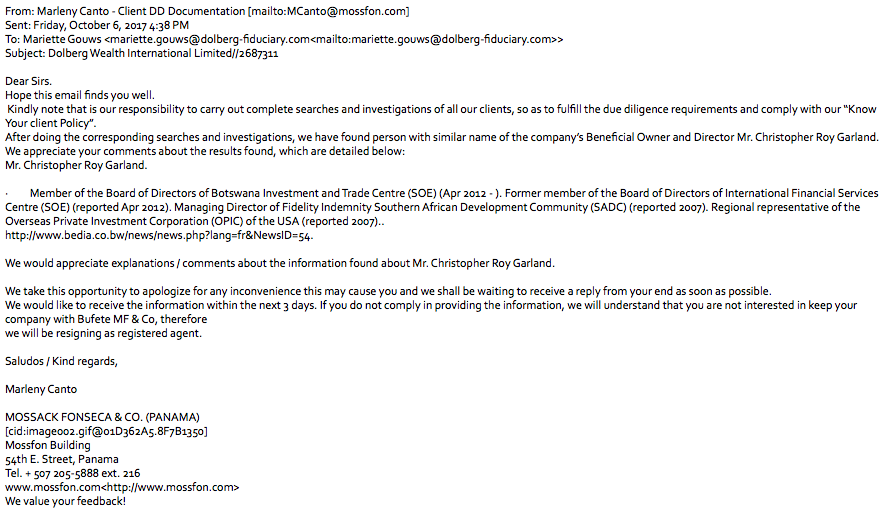

According to series of emails between Mossack Fonseca’s officers between October 2017 and December 2017, the law firm wrote to Dölberg’s Trust Administrator, Mariette Gouws, informing her that Garland may be politically exposed due to his links with state-owned entities (BITC, IFSC) and his association with Southern African Development Community (SADC).

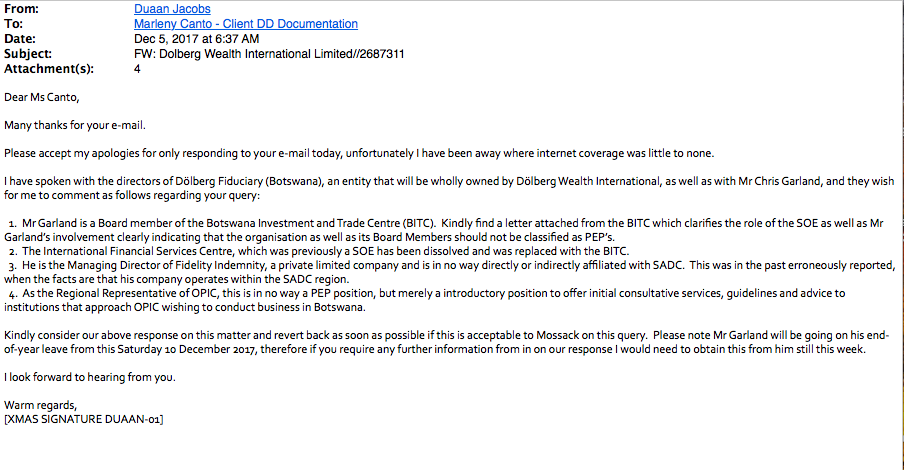

Email communication between Dölberg and Mossack Fonseca over whether Garland is a ‘Politically Exposed Person”

Marleny Canto, Mossack Fonseca officer in Panama, asked Dolberg officials in Gaborone to respond to their findings on October 6, 2017. If they failed to do so, he said the law firm would cut ties with the company. “We would like to receive the information within 3 days. If you do not comply in providing the information, we will understand that you are not interested in keeping with Bufete MF & Co, and therefore we will be resigning as registered agent,” Canto wrote.

Frustrated with Dölberg’s failure to respond, MF wrote a strongly worded email to Dölberg on November 21, 2017 cutting ties with the company. “Unfortunately, we did not receive your final comments to discard the information we sent to you. Considering that you did not reply to our email, we understand that you are not interested in keep your company with MF & Co, and therefore we will be resigning as registered agent,” wrote Canto.

BITC letter to the rescue

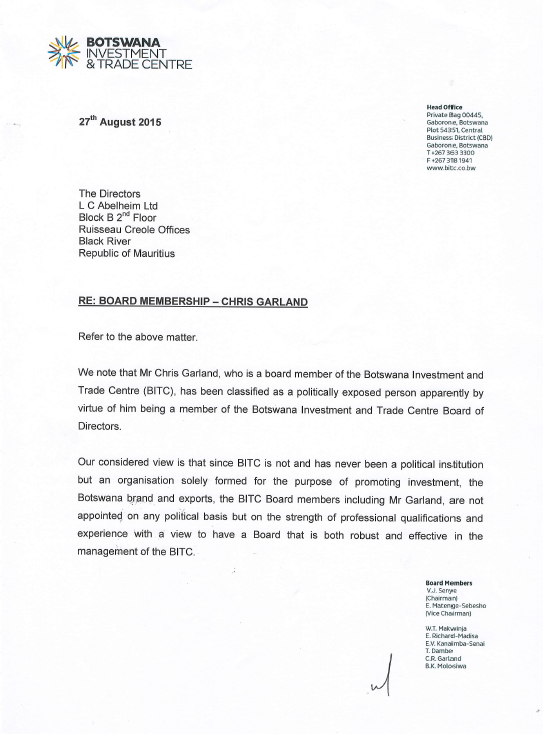

Under pressure, Dölberg Fiduciary (Botswana) Business Development Executive Duaan Jacobs wrote back begging Mossack Fonseca not to terminate services with the company. Jacobs further produced a letter from BITC’s Board Secretary Mothoothata Lesole arguing that Garland should not be classified as a politically exposed person. The letter dated August 27, 2015, was initially submitted to the directors of L C Abelheim in Mauritius, a company that specializes in assisting businesspeople to open offshore accounts in Mauritius. The company had previously classified him as ‘politically exposed person’.

Lesole argued Garland should not be considered politically exposed because BITC was not a political institution but solely formed for promoting investment, the Botswana brand and exports. “The BITC Board members including Mr. Garland, are not appointed on any political basis but on the strength of professional qualifications and experience with a view to have a Board that is both robust and effective in the management of the BITC,” wrote Lesole.

BITC probably saved Garland from being ‘excommunicated’ by Mossack Fonseca

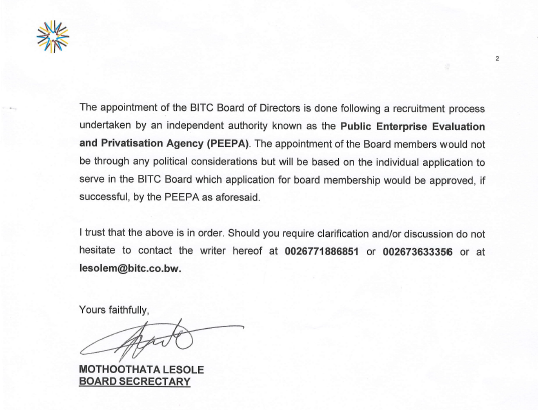

Further Lesole noted that the appointment of the BITC Board of Directors is done following a recruitment process undertaken by Public Enterprise Evaluation and Privatization Agency (PEEPA). “The appointment of the Board members would not be through any political considerations but will be based on the individual application to serve in the BITC Board which application for board membership would be approved, if successful, by the PEEPA as aforesaid”.

It is not clear whether this explanation was acceptable to MF.

Declaration of interest

Has Garland declared his interests to the BITC board? Garland says he has. “BITC was informed from the beginning of my relationship with Dölberg” says Garland. In a statement to BITC’s Director of Corporate Communications, Kutlo Moagi says that Garland declared his business with BITC when he joined the organization in 2012. Says Moagi, “According to our records, Mr. Garland declared his business interests to the BITC Board as required in terms of his duties as a Board Member from the date of commencement of his board membership with BITC.”

Garland. Pic: www.gobotswana.com

The statement, however, does not talk specifically to his interest in Dölberg. BITC public documents do not list Dölberg in Garland’s profile. For example in the 2016/2017 BITC annual report, Garland’s offshore investments are not listed. Instead according to the report, he sits Is several boards including Fugro Botswana, Transwana Group of Companies and Tagine Capital Partners.

Ironically, Garland’s interest in companies that assist wealthy people to invest in offshore tax havens may have undermined the principles for which BITC was formed, which is to attract much-needed foreign investment.

Email communications show that Dölberg Fiduciary Botswana helped families and companies in countries such as South Africa to invest their money offshore.

I am clean – Garland

Garland maintains that he has no direct ties to Mossack Fonseca, this is despite the law firm handled some of his personal documents, including his passport. Garland says that Dölberg worked only with MF in Seychelles, a service provider for Seychelles companies, and “that there was no dealing with Mossack Fonseca in Panama except compliance queries.” MF Seychelles and MF Panama are the same companies. Garland says Dölberg has stopped working with MF but, “there was a process to transfer the files to the new service provider.”

… there was no dealing with Mossack Fonseca in Panama except compliance queries – Garland

“I serve and continue to serve BITC, Botswana and the people of Botswana, to the fullest of my abilities, I continue to discharge my fiduciary responsibilities diligently,” he says in a statement. Garland further indicated that through Dölberg, investors were introduced into Botswana and had established a substantial number of structures and (Dölberg clients) have introduced ongoing investments in Botswana.

According to Garland, Dölberg employs people in Botswana and through the investments facilitated into Botswana have indirectly assisted with creating employment opportunities. Says Garland, “Dolberg promotes, among other, the same objectives as the BITC, namely to ensure investment into Botswana.”

Our man and his companies are clean – BITC

BITC supports Garland’s claims and further admitted to having entered into a business relationship with Dölberg’s predecessor Turnstone Corporate Botswana. The organization does not go into specifics, preferring to state, “Turnstone Corporate Botswana (Pty) Ltd has indeed referred clients interested in investing in Botswana to the BITC. However, in line with BITC Policy of maintaining client’s confidentiality, we are not at liberty to share the names of such companies”

According to BITC Chairperson Victor Senye, they are not aware of any information or occurrence that will make them doubt that BITC members are not observing their fiduciary duties. He says that while individual board members are free to invest wherever they wish including offshore, it is for the individual board member to ensure that their investment activities do not conflict with their duties to the company. “We are not aware of any private or personal investment activity by any of our board members which conflict with their responsibilities at BITC,” says Senye.

Reporting by Ntibinyane Ntibinyane

Join the Conversation